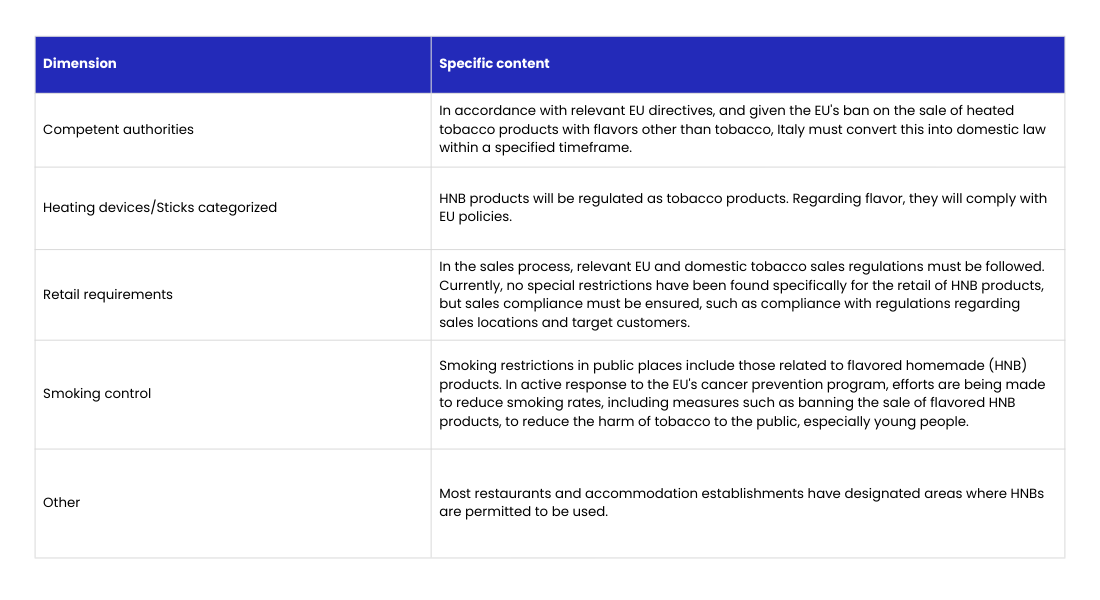

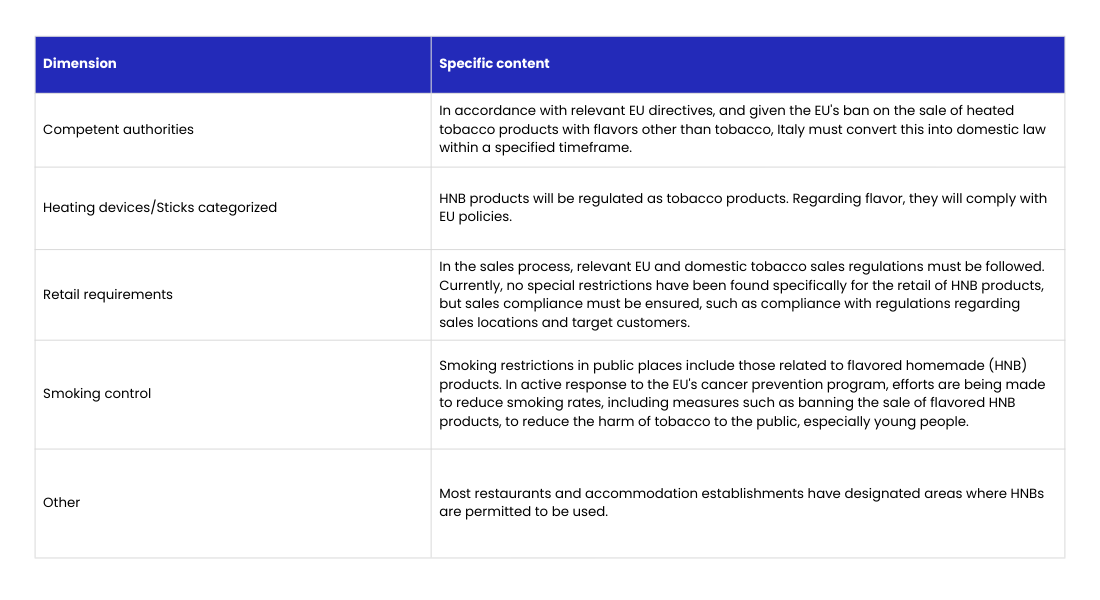

1. Regulatory Landscape: EU-Driven Compliance with Flavored-HNB Ban as a Key Variable

Italy strictly adheres to relevant EU directives regarding the regulation of heated tobacco products (HNB). The EU prohibits the sale of heated tobacco products with flavors other than tobacco, and Italy is required to transpose this directive into domestic law within a specified timeframe, thereby restricting the variety of flavors available for HNB products. In terms of product classification, Italy manages HNB products as tobacco products.

In the sales process, HNB products must strictly comply with relevant EU and domestic tobacco sales regulations. Although there are currently no specific restrictions on HNB retail, strict compliance must be ensured in areas such as the selection of sales locations and the definition of target customers, ensuring that sales activities are conducted within the legal framework. Regarding tobacco control measures, Italy restricts smoking behavior, including the use of HNB products, in public places and actively responds to the EU's anti-cancer plan, hoping to reduce smoking rates and minimize the harm of tobacco to the public, especially young people, by prohibiting the sale of flavored HNB products. However, in terms of usage scenarios, most restaurants and accommodation establishments have designated areas where consumers are allowed to use HNBs. Overall, with the increasing health awareness of the Italian public and the growing demand for relatively healthier nicotine alternatives, government regulation may be moderately relaxed in the future, but the existing regulatory intensity is likely to be maintained in areas such as advertising and marketing, use in public places, and flavor restrictions.

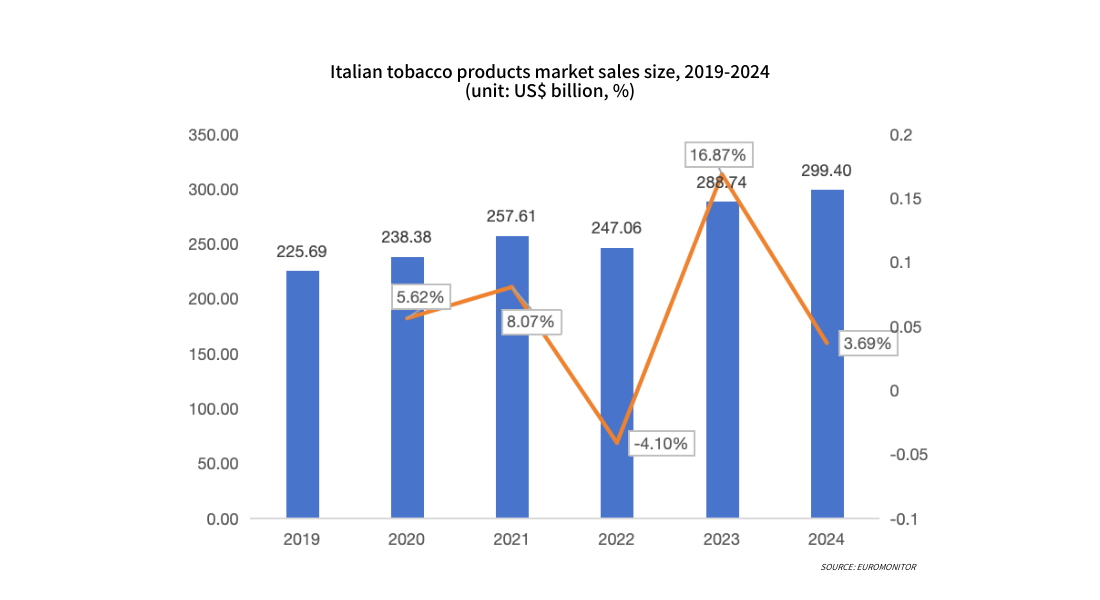

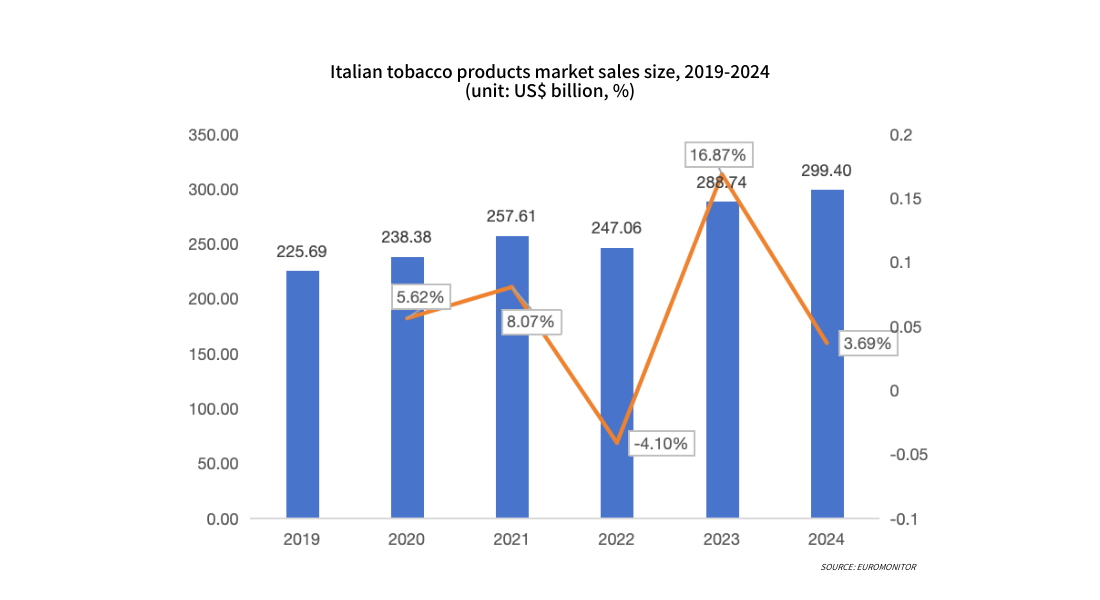

2. Italy Tobacco Market Trends: Record Size but Structural Challenges Remain

From 2019 to 2024, the Italian tobacco products market generally showed a phased trend of steady growth in the early period, followed by a short-term adjustment and then a recovery in growth. The market size contracted in 2022 due to inflationary pressures and energy price fluctuations, but rebounded rapidly in the following two years, reaching a record high of US$29.94 billion in 2024. Increased penetration of HNB products and adjustments to the consumption tax structure were the main factors supporting this growth, and future trends may be further influenced by changes in relevant EU regulatory policies.

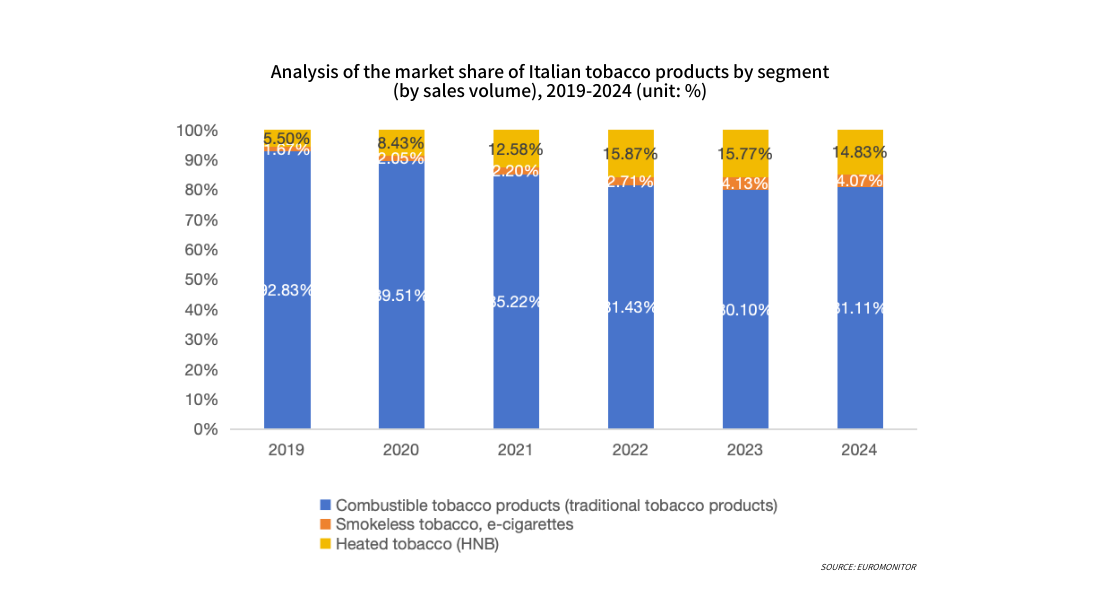

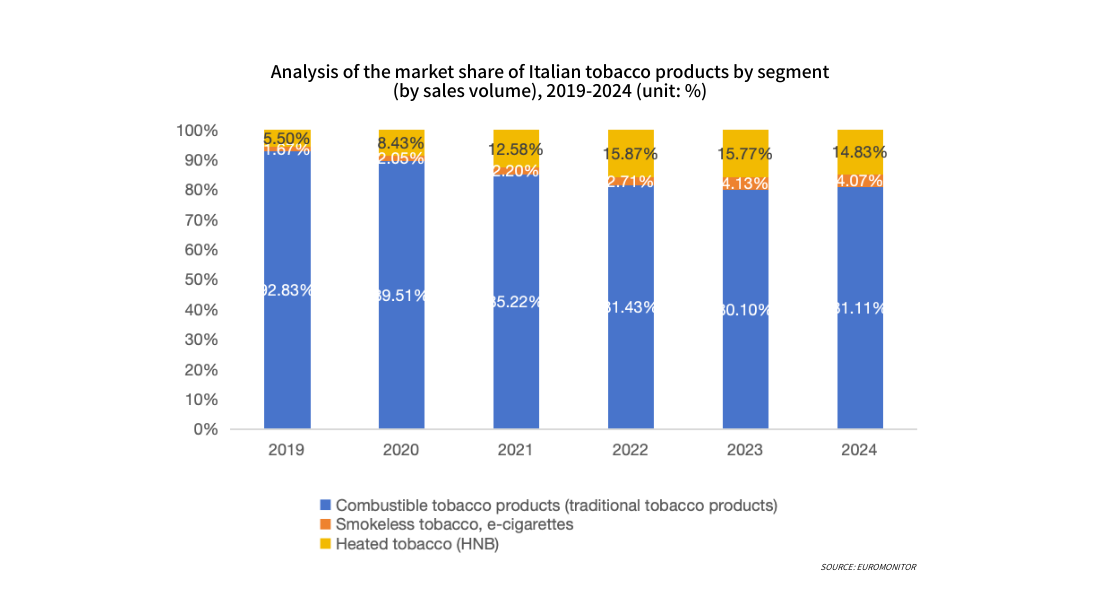

From 2019 to 2024, the Italian tobacco product market showed a structural evolution trend characterized by a gradual decline in the share of traditional cigarettes and a phased growth in heated tobacco (HNB) products. The share of traditional combustible tobacco products decreased from over 90% to approximately 80%, while the market share of HNB products grew rapidly between 2020 and 2022, followed by a slowdown in growth. The initial expansion of HNB in Italy benefited from preferential tax policies and international brand promotion, but later the growth in market share slowed down due to adjustments in consumption tax policies and changes in the overall economic environment.

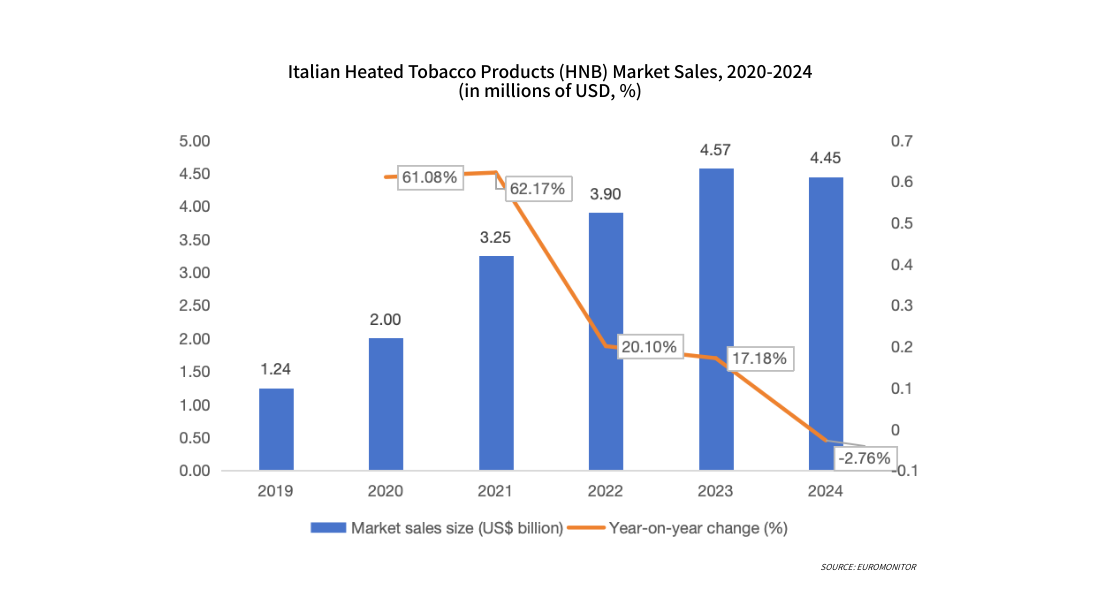

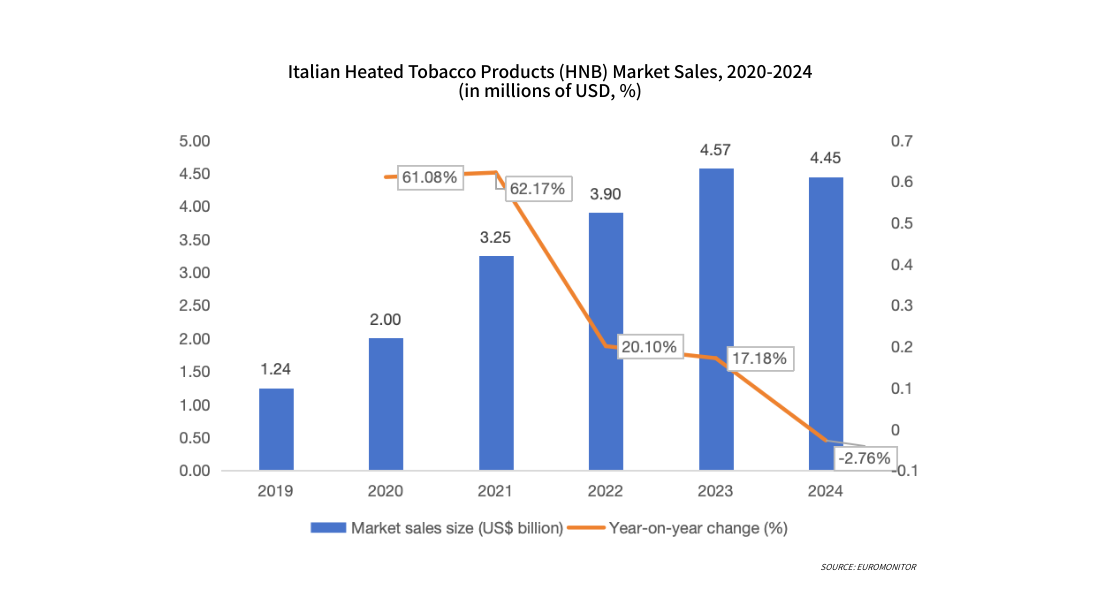

3. HNB Market Size: Strong Growth Followed by Mild Correction

From 2019 to 2024, the Italian heated tobacco (HNB) market showed an overall trend of initial growth followed by a decline. Market size increased from US$1.244 billion in 2019 to US$4.575 billion in 2023, with a high average annual growth rate, mainly benefiting from favorable tax policies and international brand promotion. In 2024, affected by EU regulations on flavored products and the macroeconomic environment, the market size slightly decreased to US$4.448 billion, but the overall penetration rate remained at a high level.

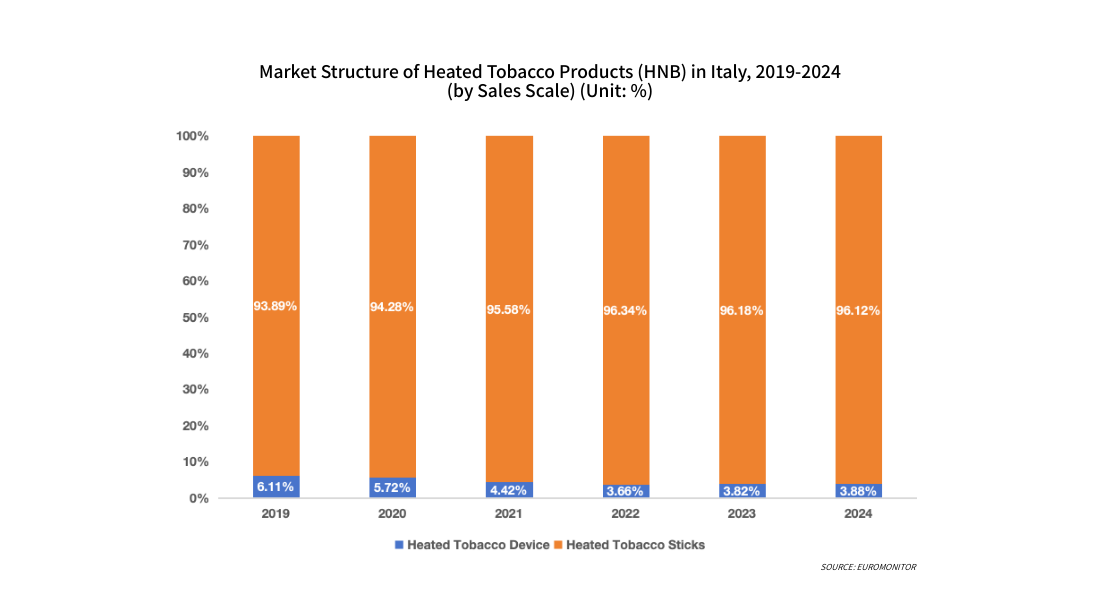

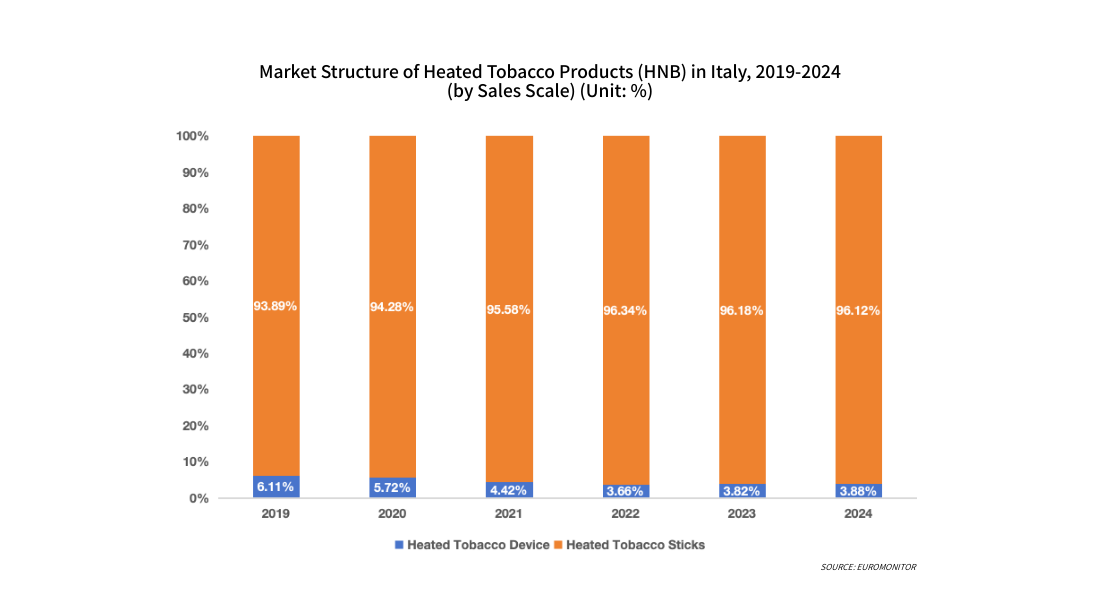

4. Market Structure: Sticks-Dominated (96%) with Declining Device Share

The Italian heated tobacco product (HNB) market continues to exhibit a structural characteristic dominated by tobacco sticks, with devices accounting for a smaller and gradually decreasing share. From 2019 to 2024, the sales share of tobacco sticks increased from 93.89% to 96.12%, while the share of devices (smoking devices) decreased from 6.11% to 3.88%. This structural evolution is closely related to the industry's business model of "attracting customers with low-priced devices and generating profits from tobacco sticks." Future market growth drivers will shift towards structural optimization of high-end tobacco stick products and adjustments in the policy environment, rather than relying on device sales expansion.

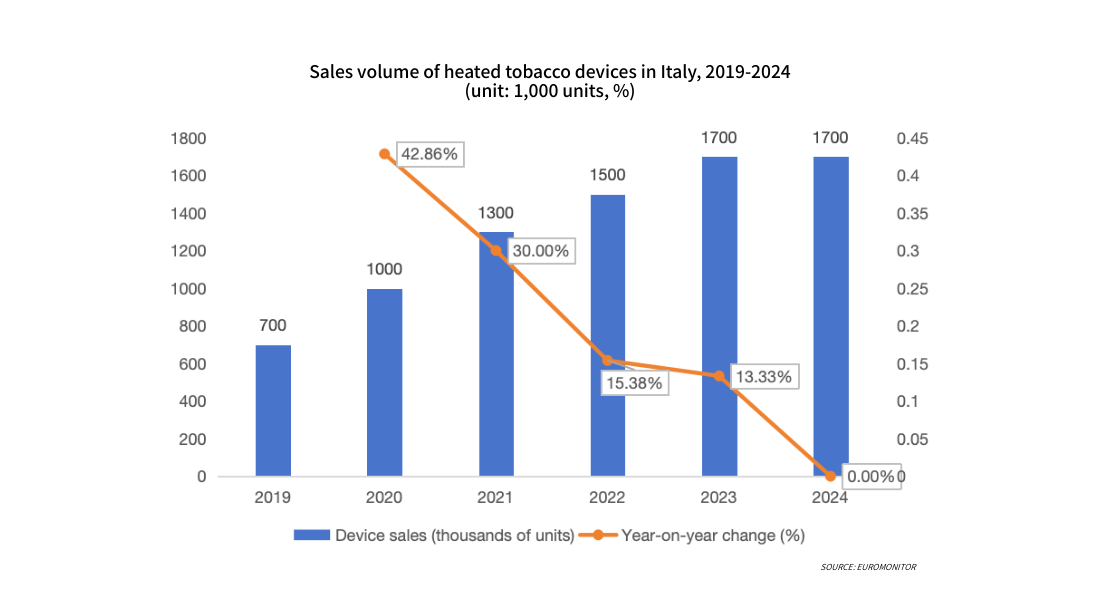

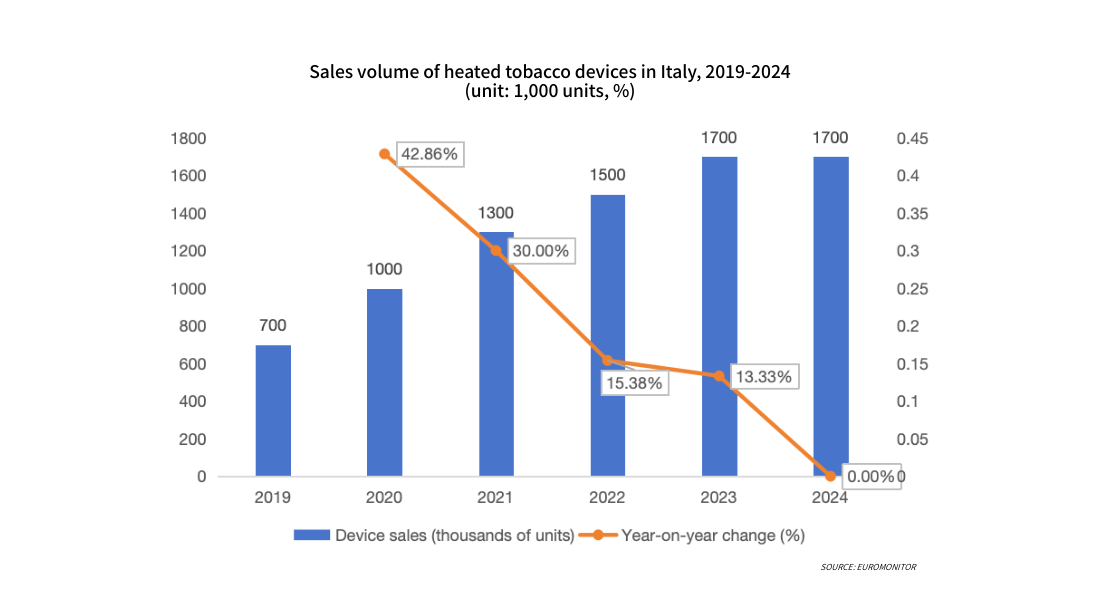

5. Volume Trends: Device Plateau and Sticks Adjustment Phase

The Italian heated tobacco device market has experienced a period of rapid growth followed by a gradual stabilization. From 2019 to 2024, sales of heated tobacco devices in Italy increased from 700,000 units in 2019 to 1.7 million units in 2024. Initially, the annual growth rate was rapid, indicating the market was in the introduction and expansion phase. However, from 2022 onwards, the growth rate slowed significantly, with sales remaining at approximately 1.7 million units in both 2023 and 2024. This trend suggests that the market has largely completed user acquisition, and demand for devices is now primarily driven by replacement purchases from existing users, exhibiting characteristics of a mature market. Future device sales are expected to remain in the range of 1.5 million to 1.8 million units.

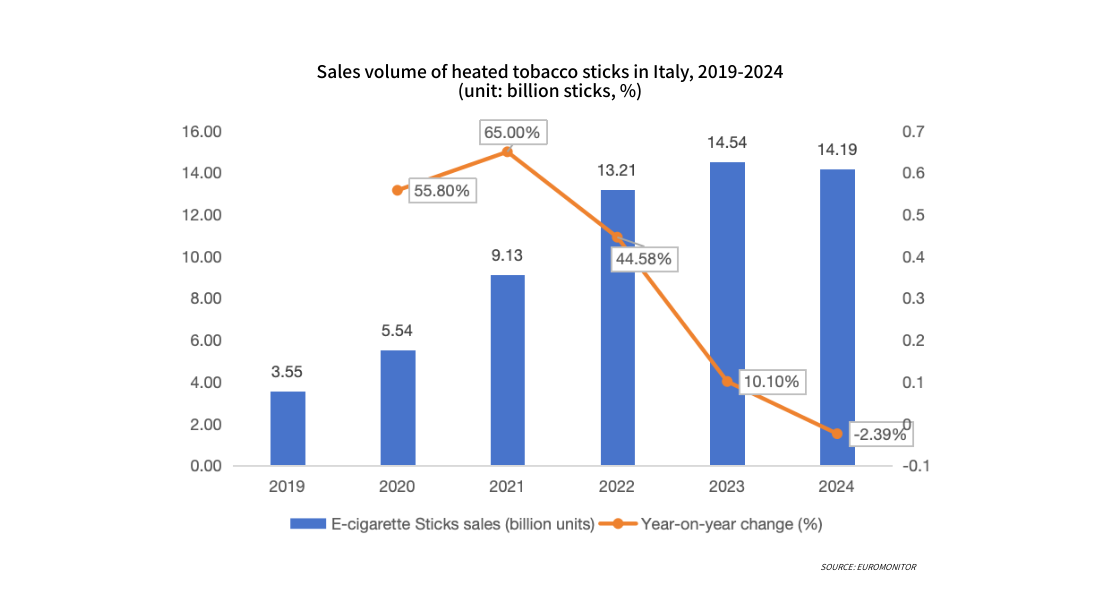

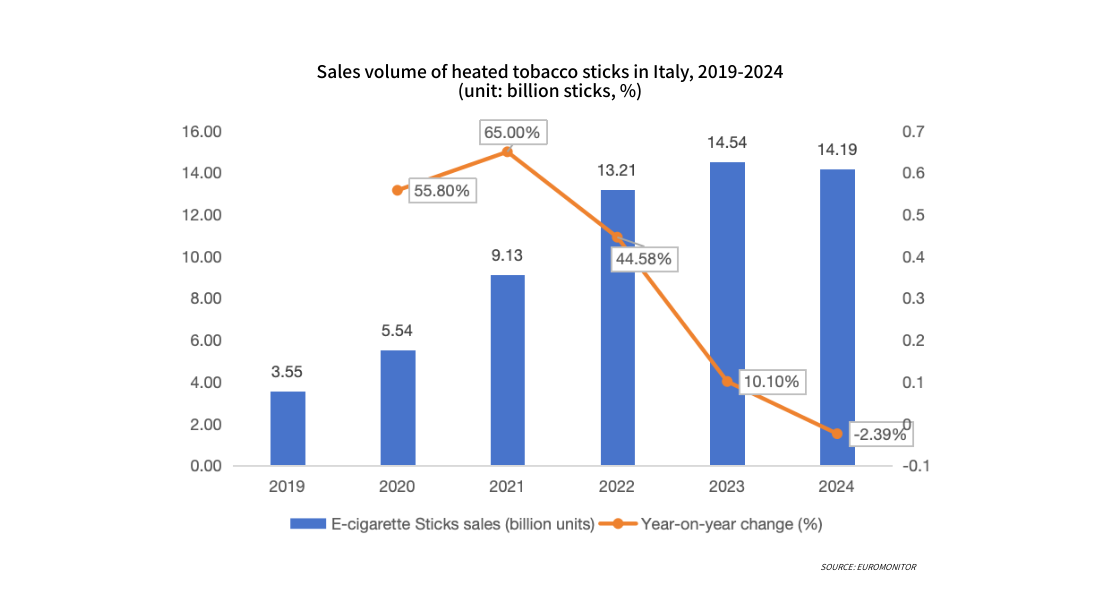

Sales volume pf heated tobacco sticks:

The Italian heated tobacco (HNB) market, after experiencing rapid growth, has begun to show a gradual decline. Sales increased from 3.553 billion units in 2019 to 13.206 billion units in 2022, with an average annual growth rate exceeding 50%, achieving rapid market penetration during the introductory phase. In 2023, the growth rate significantly slowed to 10.10%, and in 2024, it decreased by 2.39% to 14.192 billion units, indicating that the market has entered an adjustment phase. This trend is influenced by multiple factors, including EU flavor restrictions, changes in product category structure, and shifts in consumer behavior. The future market size is expected to remain stable at the current level, with growth potential more dependent on the introduction of high-value-added products and improvements in the relevant policy environment.

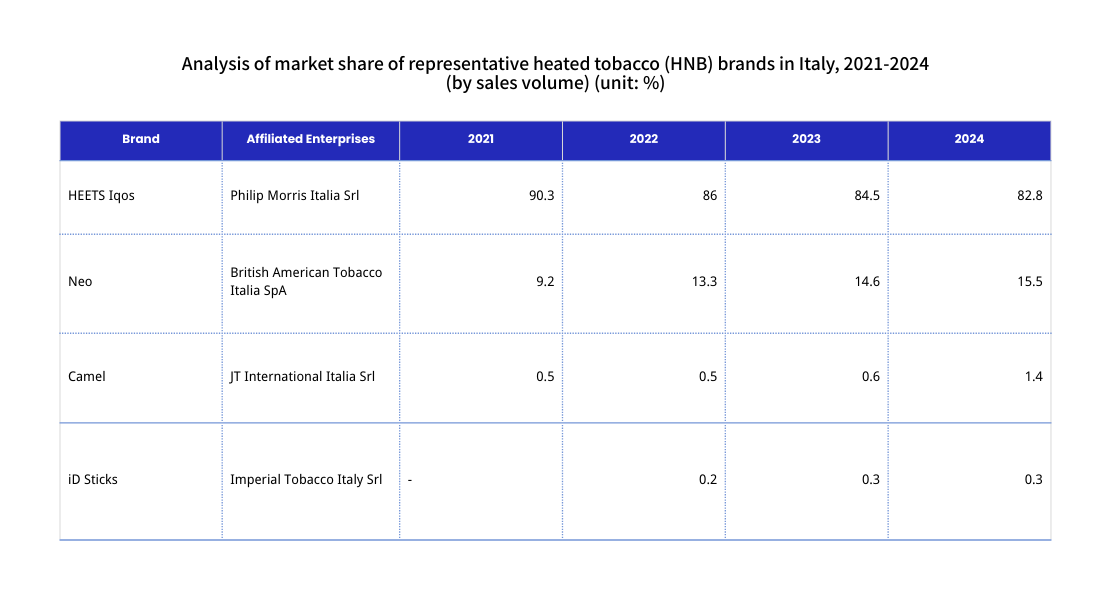

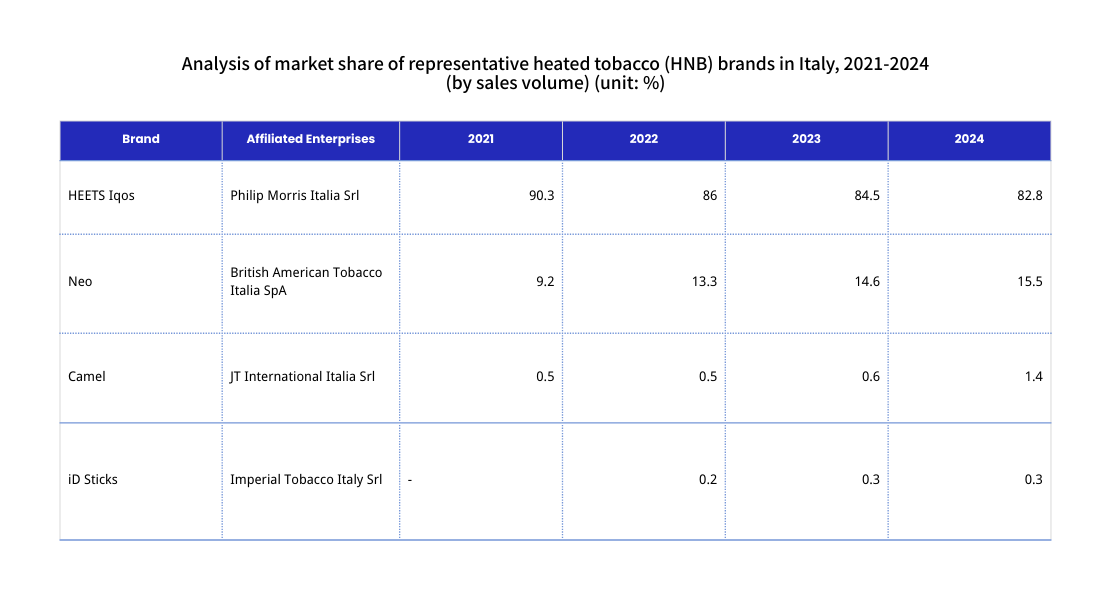

6. Brand Landscape: PMI Dominance with Steady BAT Gains

The Italian heated tobacco product (HNB) market is dominated by two major international companies, exhibiting a highly concentrated market structure and a gradually stabilizing market share distribution. Philip Morris International's (PMI) HEETS Iqos brand still holds a dominant position, but its market share decreased from 90.3% in 2021 to 82.8% in 2024. During the same period, British American Tobacco's (BAT) Neo series steadily increased its market share to 15.5% in 2024 through product technology upgrades and market promotion. Japan Tobacco (JT) and Imperial Tobacco's related brands accounted for less than 2% combined during the same period, having limited impact on the overall market structure. In 2024, the two leading brands together accounted for over 98% of the market share, indicating a high degree of industry concentration.