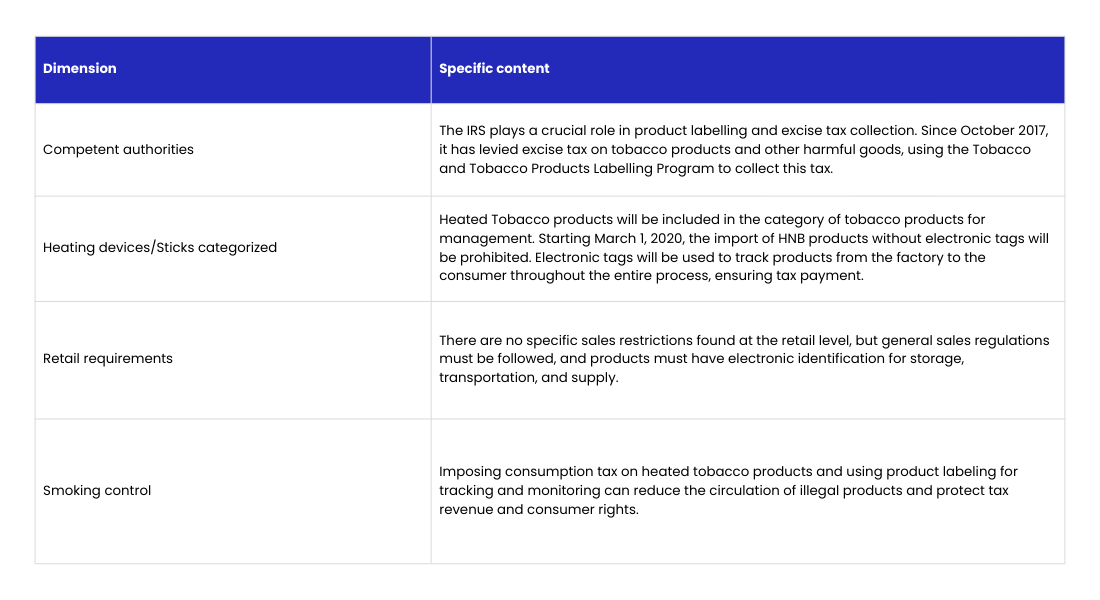

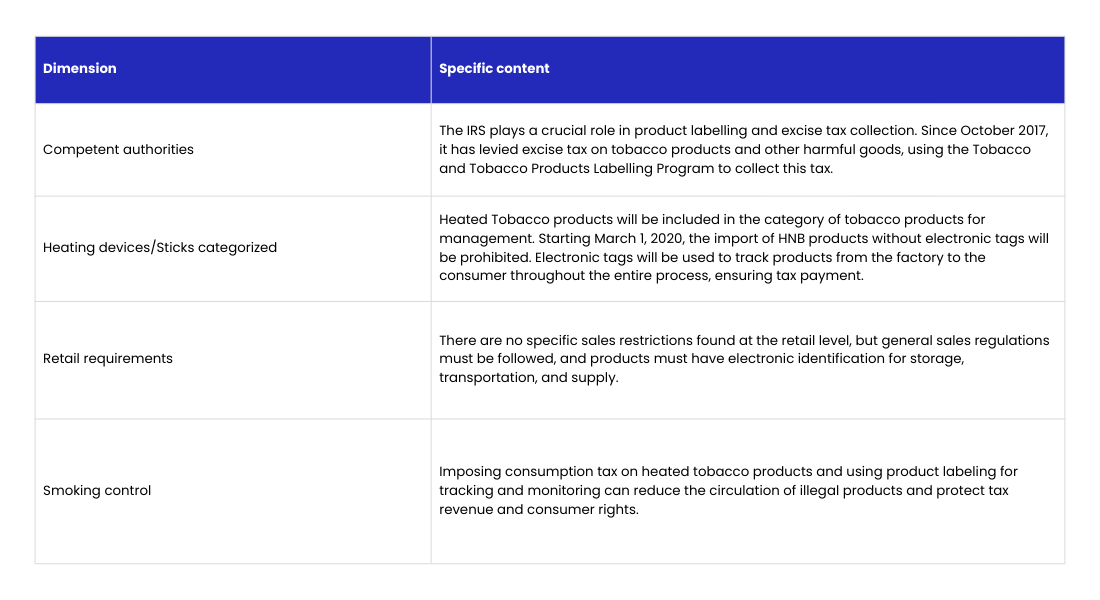

1. Regulatory Landscape: A Strong Certification & Tracking System via ECAS

Heated tobacco products (HNB) in the UAE are primarily regulated by the Federal Revenue Department. The Emirates Standards Authority (ESMA), established under UAE Federal Law (28), 2001, is the UAE's sole national standards body and certification authority. To effectively implement UAE national standards, ESMA's conformity assessment department has implemented a product safety certification system, known as the Emirates Conformity Assessment Scheme (ECAS), which came into effect on June 1, 2011. According to the ECAS scheme, all regulated products must apply for and obtain a Certificate of Conformity (COC) as a permit for customs clearance and sale.

ECAS certification covers more than just safety; it encompasses aspects such as safety testing, performance testing, functional checks, and hazardous substance detection for electronic and electrical products. In 2021, the ECAS regulatory body changed to MolAT (Ministry of Industry and Advanced Technology). HNB products require testing and certification in accordance with the requirements of standard UAE.S 5030:2018.

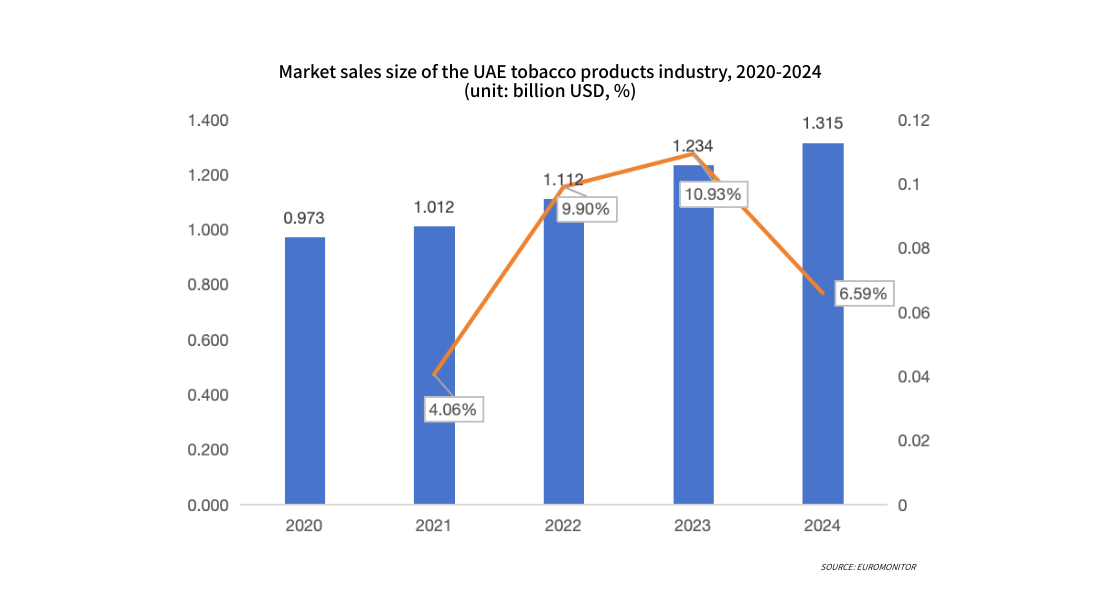

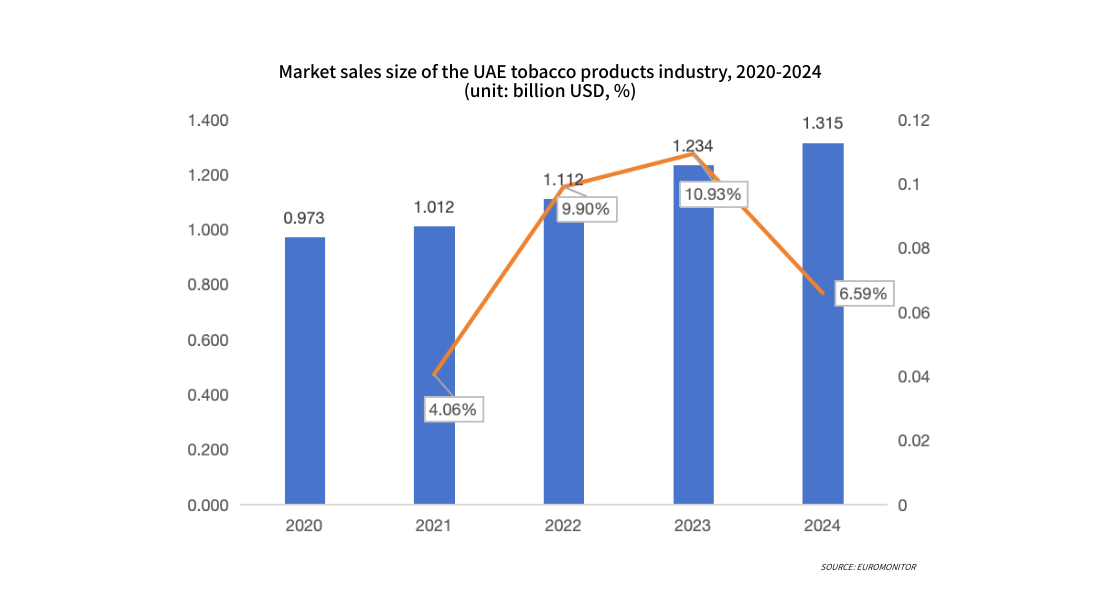

2. UAE Tobacco Market: Steady Growth with HNB as a Structural Driver

The UAE tobacco products market maintained overall growth, increasing from US$0.973 billion in 2020 to US$1.315 billion in 2024, with an average annual growth rate of 7.8%. The growth rate slowed to 4.06% in 2021 due to the pandemic; however, it gradually recovered over the next two years, achieving growth of 9.90% and 10.93% in 2022 and 2023 respectively. The growth rate fell back to 6.59% in 2024, indicating that the market is gradually transitioning from a rapid expansion phase to a relatively mature stage. Market expansion was mainly driven by factors such as the increase in the number of foreign workers and tax exemption policies. Future growth trends will be influenced to some extent by the increasing penetration rate of next-gen tobacco products and adjustments to the excise tax policy.

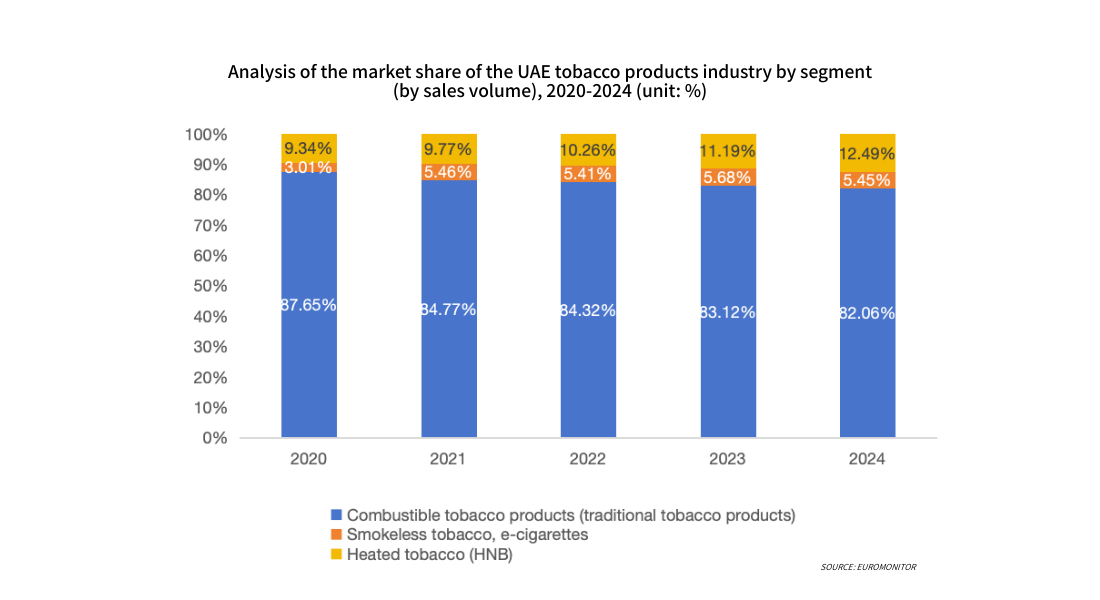

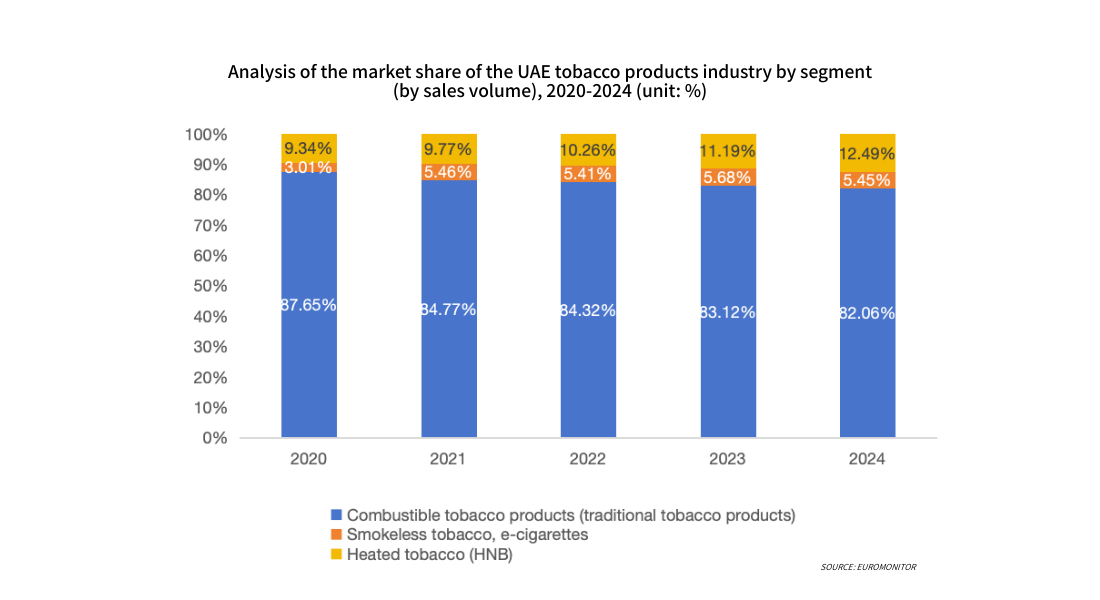

The UAE tobacco market structure is evolving, with traditional cigarettes dominating and heated tobacco products (HNB) slowly penetrating the market. The market share of traditional combustible tobacco products decreased from 87.65% in 2020 to 82.06% in 2024, an average annual decline of approximately 1.4 percentage points. During the same period, the market share of Heated tobacco products increased from 9.34% to 12.49%; the market share of e-cigarettes and smokeless tobacco remained below 6%, with little change. Overall, heated tobacco is gradually replacing traditional tobacco in the UAE tobacco market, but the pace of replacement is relatively slow due to multiple factors, including restrictions on its use in public places and the influence of traditional hookah culture.

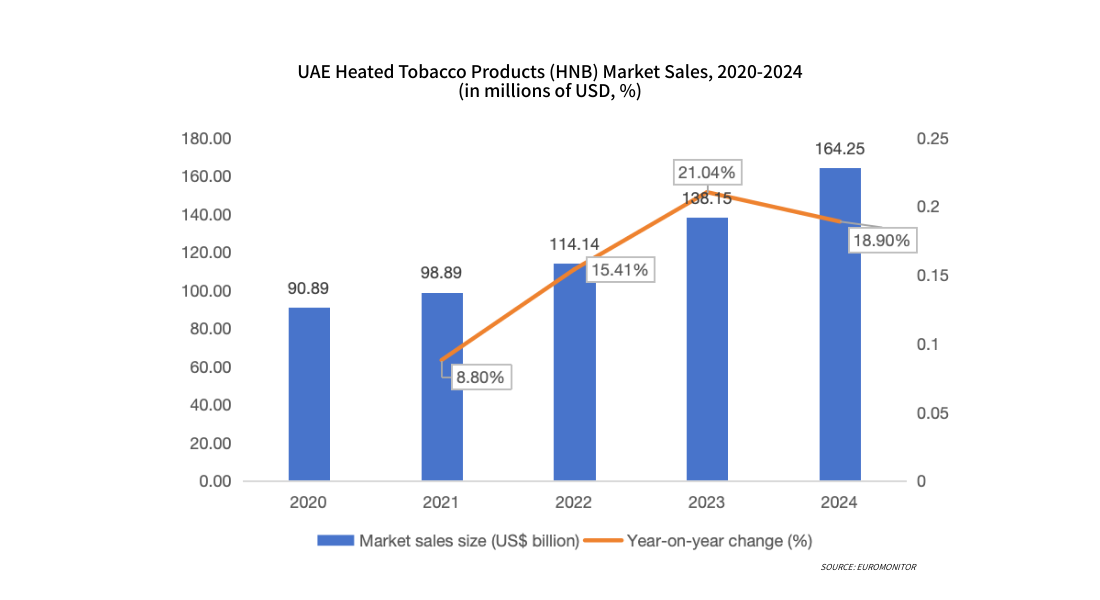

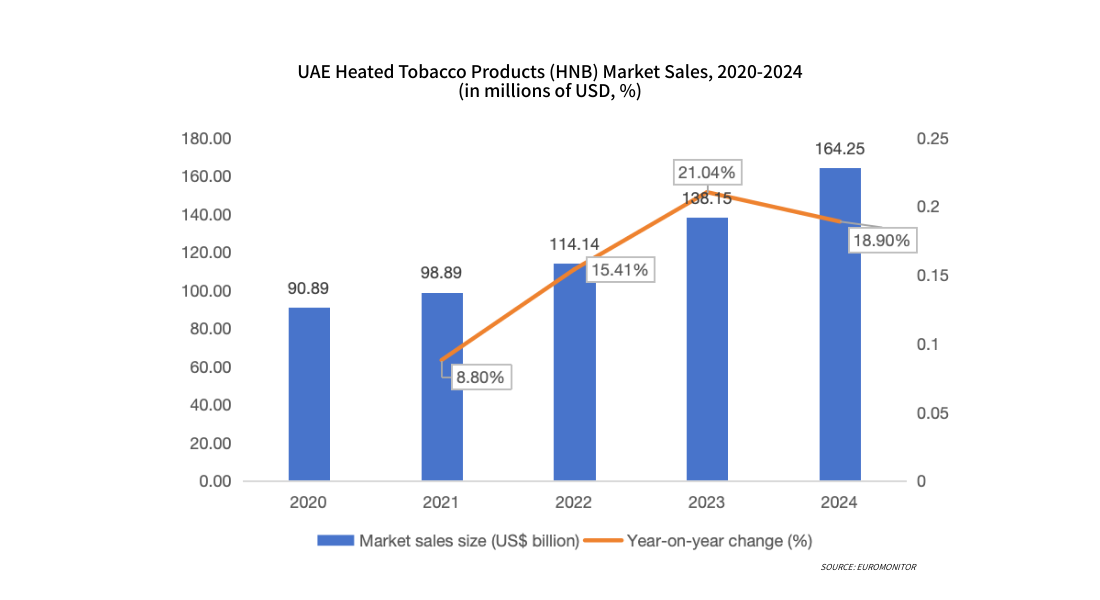

3. HNB Market Size: 15.8% CAGR—Leading the Middle East

From 2020 to 2024, the UAE heated tobacco products (HNB) market continued to expand, growing from US$90.89 million to US$164 million, with an average annual growth rate of 15.8%. The annual growth rate steadily increased, with nearly 20% growth in both 2023 and 2024, indicating that the market has entered a phase of rapid market penetration. Although the current size of the UAE HNB market is relatively limited, its growth rate is among the highest in the Middle East. The expansion of the UAE HNB market is driven by a combination of factors, including duty-free coverage, high-income expatriates driving consumption of high-end products, and travel retail channels such as Dubai Duty Free. However, traditional hookah culture, to some extent, inhibits heated tobacco penetration.

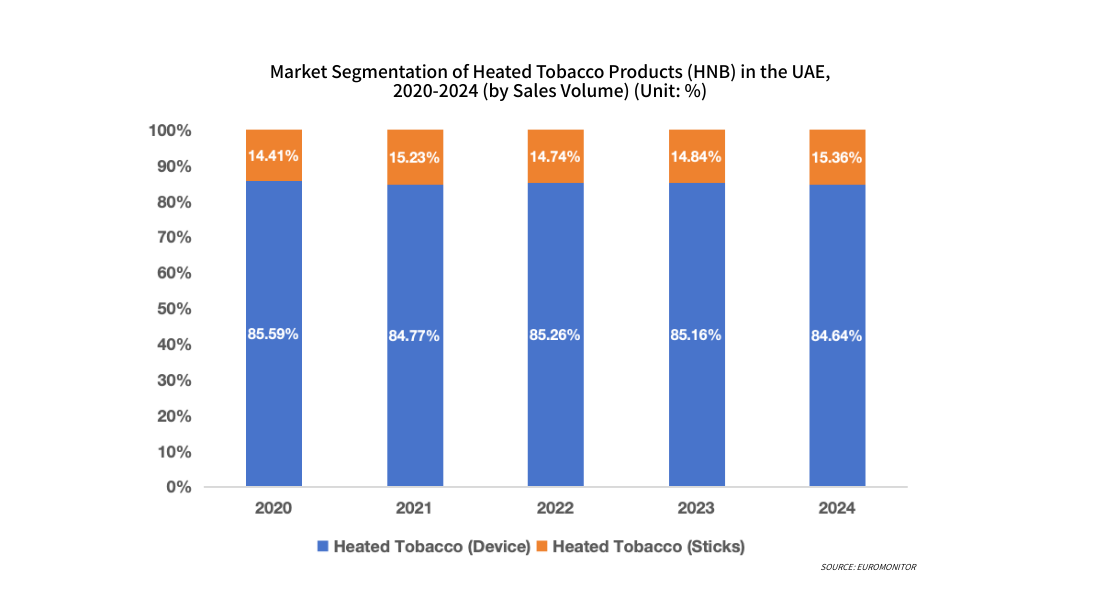

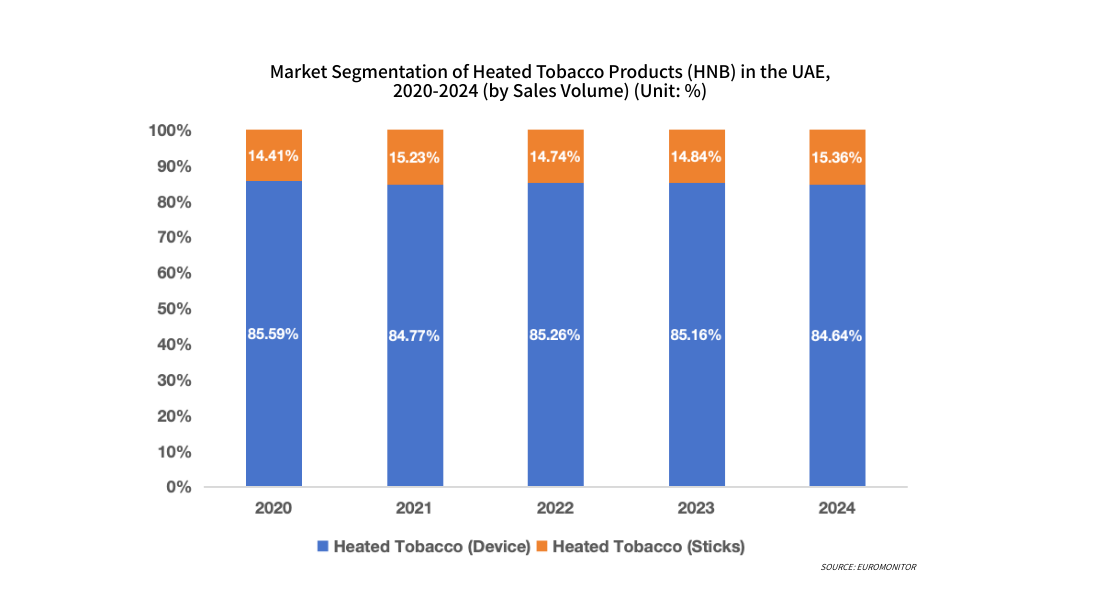

4. Market Structure: Device-Heavy (84.6%) with Lower Stick Repurchase

From a market structure perspective, the UAE heated tobacco products (HNB) market is characterized by device sales dominating, while the share of cartridge sales is slowly increasing. The share of heated tobacco device sales in the UAE remained above 80% from 2020 to 2024, reaching 84.64% in 2024. During the same period, the share of sticks sales rose slightly from 14.41% in 2020 to 15.36% in 2024, with an average annual increase of approximately 0.24 percentage points, indicating relatively gradual structural changes. This characteristic is mainly influenced by the tourism retail channel, especially in scenarios such as Dubai duty-free shops, where devices are often purchased as high-end souvenirs, forming a consumption pattern dominated by device sales. However, due to restrictions on use in public places and local tobacco culture preferences (such as hookah), the repurchase rate of sticks is relatively low. In the future, if the policy environment is adjusted (e.g., allowing the use of heated tobacco products in specific locations), coupled with product innovation tailored to Middle Eastern consumer habits, the share of cartridge sales is expected to increase more significantly, thereby driving the market structure towards a more balanced direction.

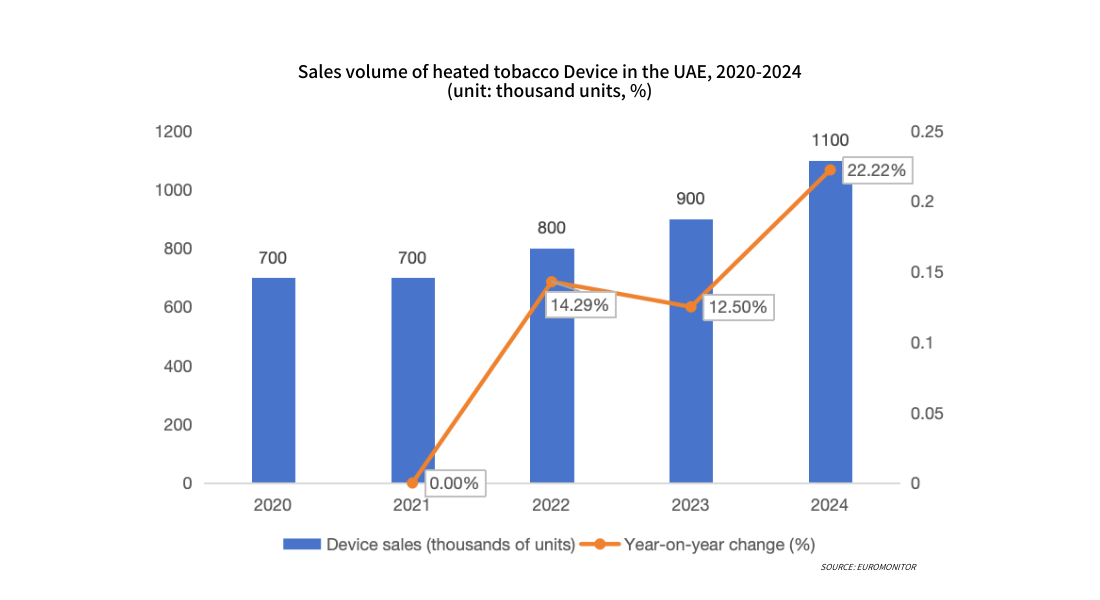

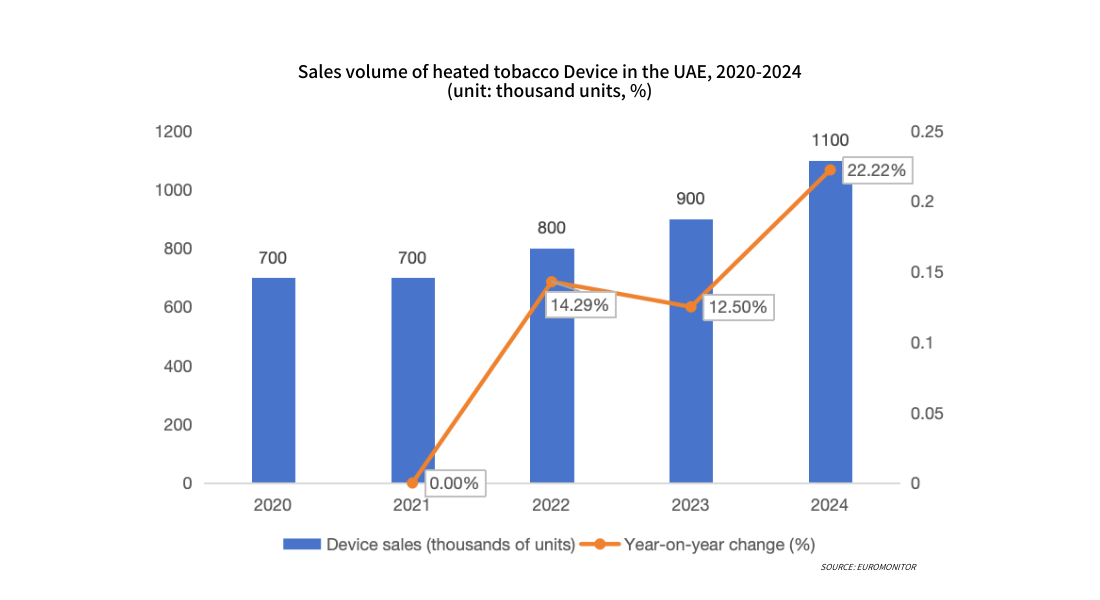

5. Volume Trends: Record Device Sales & Accelerating Stick Demand

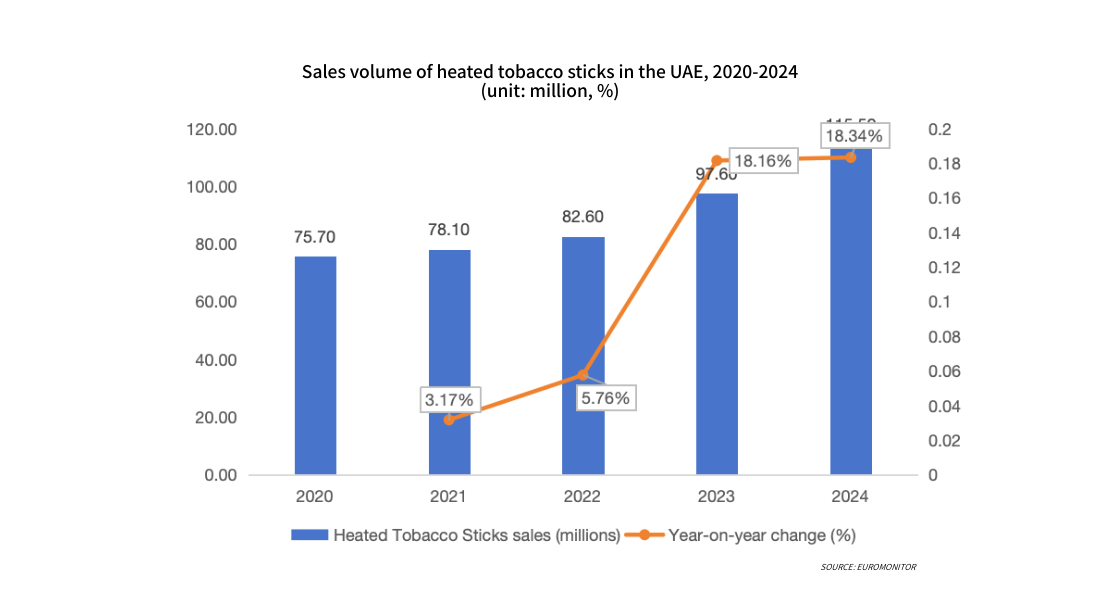

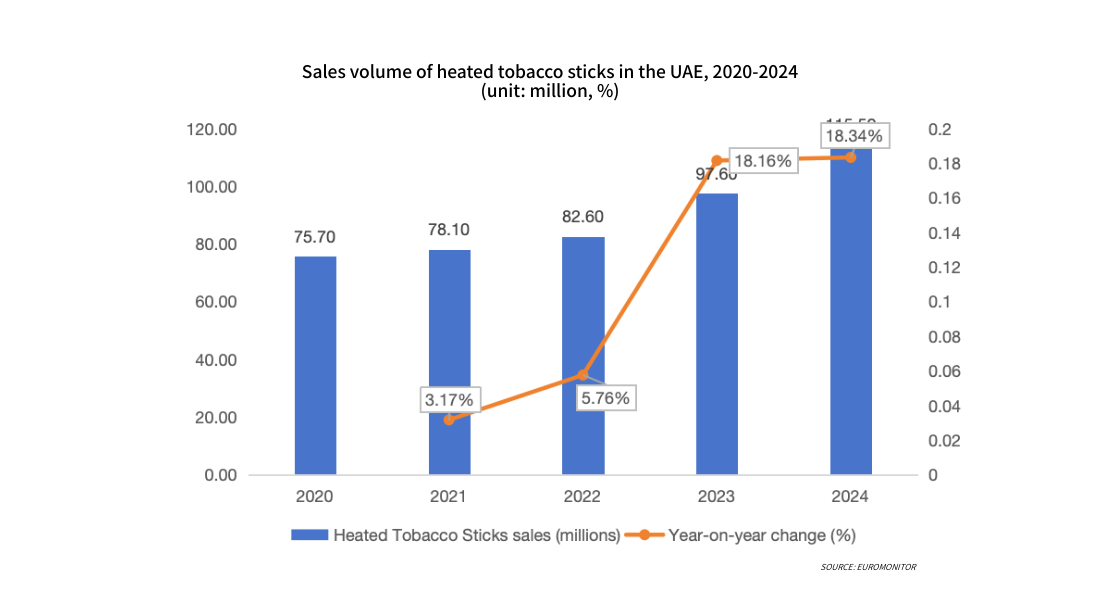

Sales of heated tobacco devices in the UAE have shown a phased, accelerated growth trend. Sales remained at 700,000 units in 2020-2021, began to recover in 2022 with a 14.29% increase to 800,000 units, and surged by 22.22% year-on-year to reach a record high of 1.1 million units in 2024. This growth was primarily driven by the recovery in tourist numbers, the promotion of duty-free channels, and the replacement demand spurred by the launch of new-generation products (such as IQOS ILUMA). The growth in heated tobacco product sales was more significant than the growth rate of tobacco cartridge sales during the same period (18.34% in 2024).

The UAE heated tobacco sticks market is transitioning from moderate growth to accelerated expansion, with sales volume increasing from 76 million units in 2020 to 116 million units in 2024, representing an average annual growth rate of 11.2%. This growth is primarily driven by policy support (such as the lifting of the ban on heated tobacco sales and tax exemptions in 2019) and brand promotion, particularly the increased adaptability of international brands in product localization, which has enhanced user loyalty. Although the current penetration rate of HNB in the UAE is still lower than in mature markets such as Japan and South Korea, further easing of relevant policies (such as relaxing restrictions on its use in public places) could allow the market to maintain a medium-to-high growth rate of over 15%. However, competition from e-cigarette products and traditional hookah consumption habits may still constrain its further market share expansion to some extent.

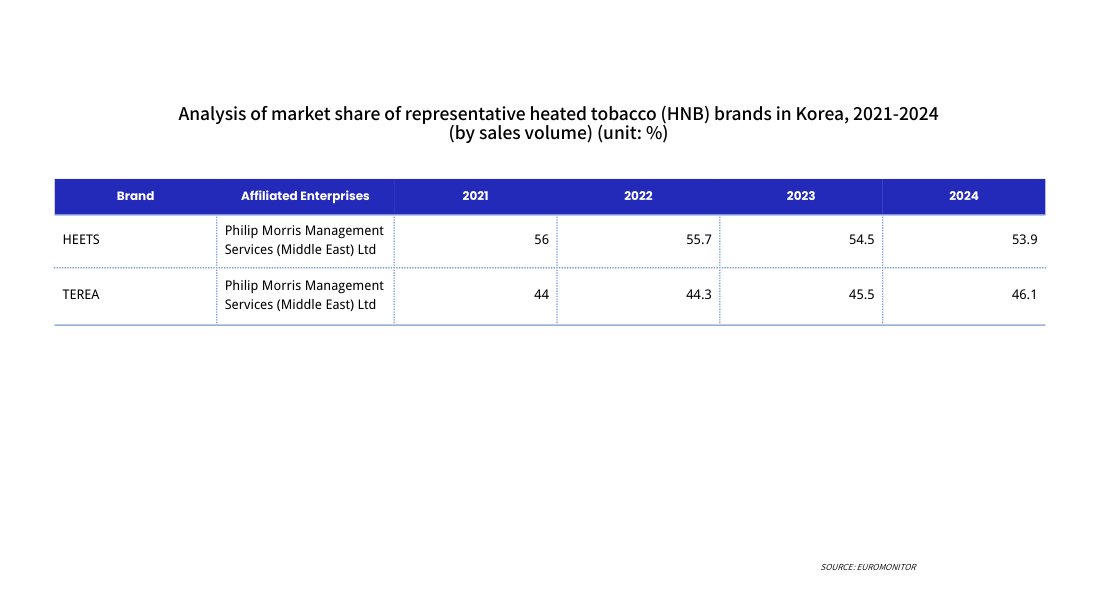

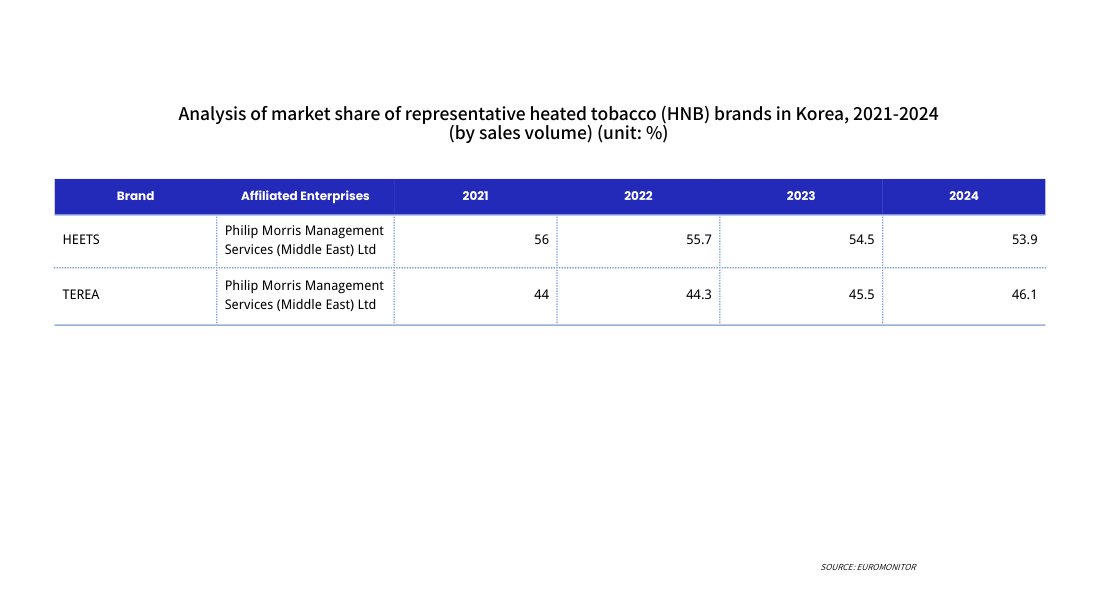

6. Brand Landscape: PMI Monopoly with a Shift from HEETS to TEREA

From 2021 to 2024, the UAE heated tobacco products (HNB) market exhibited a highly concentrated brand landscape, dominated by a single brand system led by Philip Morris International (PMI). Specifically, the market share of the traditional brand HEETS slightly decreased from 56.0% in 2021 to 53.9% in 2024; while the market share of TEREA products used in the IQOS ILUMA induction heating device increased from 44.0% to 46.1%, indicating that TEREA has become a substitute for HEETS to some extent in the context of technological advancements. Due to the closed-loop system of the device-cartridge model and supportive import and regulatory policies, PMI maintained its monopoly position in this market, with overall market share fluctuations not exceeding 3 percentage points, indicating relatively limited market activity. Whether the brand landscape will change in the future will largely depend on the degree of openness of regulatory policies and the possibility of other brands entering the market.